Sec valkyrie kryptoin bitcoin trusts

2.2 The CSSA is made with a “regulated” market of significant size.

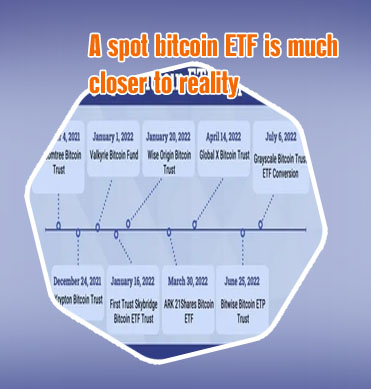

One River wheeled out the big guns in its bid to win over the SEC, bringing on former SEC Chair Jay Clayton as an adviser. Clayton, who joined the firm prior to its Bitcoin ETF application, headed the SEC during a period when it rejected every application for a Bitcoin ETF.You can probably guess what happened in May 2022... Sec rejects valkyrie bitcoin trusts The Securities and Exchange Commission said this month it would seek public comment on WisdomTree’s proposal to launch a bitcoin ETF, focusing on whether the fund would be safe for investors. The agency has already sought comment on pitches from at least four other firms: SkyBridge Capital, VanEck, Valkyrie Digital Assets and Kryptoin Investment Advisors. Sec valkyrie kryptoin bitcoin trusts The US Securities and Exchange Commission (SEC) has rejected the Valkyrie and Kryptoin Spot ETF functions. The authority has not but authorized the implementation of the Bitcoin ETF.

Sec rejects valkyrie bitcoin

Gary Gensler, the chairman of the SEC, has indicated the agency is in favor of ETFs related to bitcoin futures, but not those based on the cryptocurrency itself. It has rejected or delayed applications, even as American investors can access spot bitcoin ETFs listed in Canada. January saw Bitcoin's highest monthly volume since September 2022 The Grayscale Bitcoin Trust, or GBTC, has a few favorable characteristics. Most notably, it has been trading since 2015 as a closed-end fund.

For Customers

Whether the appetite for spot bitcoin ETFs is overblown is another key concern among investors. A February To Remember? As other spot bitcoin ETFs await approval, the SEC allowed ProShares to launch a bitcoin futures ETF on October 19, and a similar fund by Valkyrie came to market three days later. Futures-based bitcoin offerings from VanEck and Global X are also expected to launch.

Sec valkyrie kryptoin bitcoin trusts

One of Commissioner Uyeda’s criticisms was around the last minute approval process, waiving 30 day notice requirements for changes to ETF applications. He disagreed with the reasoning given for accelerating the processes. “Perhaps the actual motivation for accelerating the approval is to avoid a first-mover advantage whereby the first spot bitcoin ETP to market acquires the lion’s share of investor assets,” he wrote. “In my view, the Commission could have formed its “good cause” finding by referencing the potential anti-competitive results.” RIABiz Directory The news came as a shock to some as they hoped that the SEC’s position would adopt a favorable stance. In 2021, the regulator denied four spot Bitcoin ETF applications and showed little to no signs of changing its opinion on a physically-backed Bitcoin ETF. VanEck was the first to be denied in November as the company had made the application in December 2021 and had to wait almost a year for a decision.

Ready To Get Started?